Explore Technology

Technology

Latest about Technology

AI is narrowing the performance gap between high and low skilled workers, but over-reliance is a concern – report

By Steve Ranger published

News Stanford University's Annual AI Index reveals the extent to which AI has influenced modern workplaces, and how it may shape business in the years to come

Reinventing procurement

By ITPro published

Whitepaper From cost center to innovation driver

Most developers will soon use an AI pair programmer — but the benefits aren’t black and white

By Steve Ranger published

News Generative AI coding tools can help developers work smarter, even if huge productivity gains may prove elusive

AMD Ryzen™ PRO processors and Windows 11 Pro

By ITPro published

whitepaper Better together for enterprise

Big tech companies insisted 2024 would be the year of the AI PC - analysts disagree

By George Fitzmaurice published

News Forrester suggests that this year will be more of a warm-up in AI PC adoption ahead of 2025

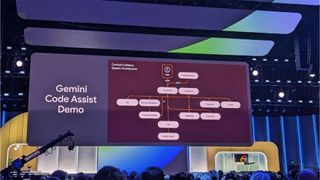

Google Cloud’s AI potential is finally convincing

By Rory Bathgate published

Analysis Google Cloud now has a compelling and unique offering for enterprises after hitting the reset button a year into the AI arms race

Google Cloud Next 2024: Building an AI advantage

By Rory Bathgate published

ITPro Podcast Google's data heritage could be just the right ingredient as it takes on the AI market at scale

Accelerate your growth with GenAI from IBM

By ITPro published

WEBINAR Increase your impact and grow new revenue streams

Get the ITPro. daily newsletter

Receive our latest news, industry updates, featured resources and more. Sign up today to receive our FREE report on AI cyber crime & security - newly updated for 2024.