Best free project management tools

Boost your team's productivity with these B2B-focused project tools

Whether your business runs formal projects such as product launches or updates, software rollouts as part of a digital transformation strategy, or you just need to keep track of everyday resource and time-limited tasks, project management tools should be a vital part of your business's IT set up.

They vary in feature set, from basic task tracking to fully-fledged resource, time and cost management platforms, with collaboration, accountability and every single detail your teams need access to built in.

Like their features, project management tools can vary significantly in price, with those offering basic functionality often free or with free trials, allowing you to try for a limited time before you buy. But with so many to choose from, how can you find the tools you need to power your business and make projects run as smoothly as possible?

We've rounded up the top project management tools to help you choose one right for your business before you commit.

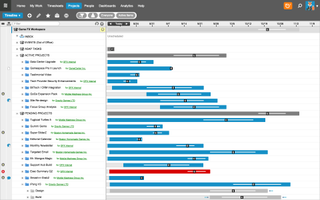

LiquidPlanner

LiquidPlanner is a project management tool that's built upon schedules to ensure projects run smoothly. It allows businesses to plan, track, schedule, collaborate and manage resources across multiple projects, so everyone involved knows what's expected and when.

LiquidPlanner also includes key insights on resource availability alongside other data-driven observations, allowing for in-depth project management. There are three plans available, suited to different sizes of organisation and each is billed annually. Each supports a different number of active tasks and users, with the small business/standard plan offering the fewest (250 tasks and five users).

Alongside core project management and scheduling tools, LiquidPlanner also offers free storage, plus integrations with Box, Dropbox, and Google Drive, allowing for collaboration on files and folders.

Platforms: Android, iOS, web

Zoho Project Management

Zoho Project Management is definitely one of the best project management tools out there, with features you'd expect to experience on a subscription-based platform. However, one of the big caveats is that although you can have unlimited users in your team, you'll have to be careful about what you share, because the free version only includes 10MB storage and upgrading to unlimited will set you back $25/month.

Platforms: Android, iOS, web

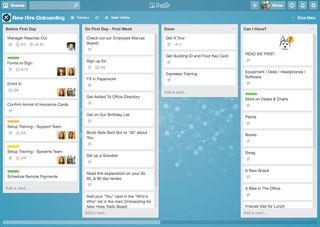

Trello

With its drag and drop card-based interface, Trello is super-easy to use. It also boasts a huge range of integrations with third-party applications such as Google Drive, so you can't really go wrong. Everything is customisable, allowing you to add columns according to the individual project, and colour-coding task cards however you like. You can also easily assign tasks by tagging users on a card and setting deadlines. The more people you invite to your board, the more credits you get, which will allow you to upgrade to gold with higher storage limits for free.

Platforms: Web (mobile and desktop versions available via third parties)

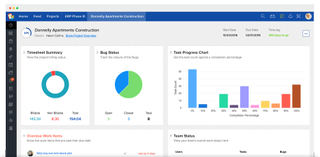

Asana

First developed by Facebook engineers for internal use, this cloud-based tool is designed to help users manage the progress of various projects. Essentially an alternative to Trello, it allows users to create tasks, assign users to them, set due dates and add comments.

Its strength lies in its minimalist approach to project management, offering a more streamlined experience compared to other suites, while still offering similar levels of functionality. Asana currently has integrations with Gmail and Google Drive, Dropbox and Slack, as well as a host of other third-party applications.

Asana is available as a free tool for smaller teams, with support for up to 15 users, although this only grants partial access to its range of features.

A full-fat version is available starting at $9.99 per month, which opens up all of its features without a restriction on the user count. For more advanced tools, there's also an enterprise plan that adds branding options and enhanced security and data protection services.

Platforms: Android, iOS, web

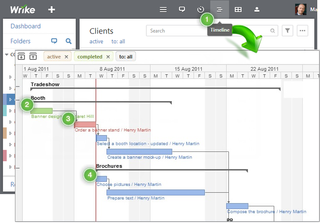

Wrike

If you only have a small team, Wrike offers its full version for free, which makes it a top choice for businesses just starting out. Like Trello, it integrates with a whole host of third-party apps such as Dropbox, so you can easily link your files with project documents. Collaboration is at the centre of this free project management tool, including a private messaging function, so you can scrap to-and-fro emails and just use Wrike to communicate for everything project-related.

Platforms: Android, iOS, Web

Freedcamp

Freedcamp takes a more traditional approach to project management, helping keep all the admin in one place, as well as tracking project progress. The free version is pretty basic, but you can add modules on to help cover your entire business process, including CRM, meaning Freedcamp can scale as your business grows.

Like Trello, it uses a Kanban board-style UI, allowing you to drag and drop tasks as they progress through the project. Task lists are present to keep your teams organised, and it can even create Gantt charts to help you present your progress to stakeholders.

Platforms: iOS, Web

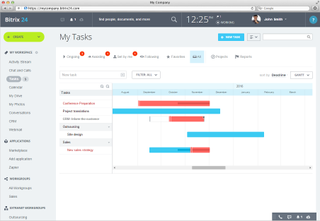

Bitrix24

Bitrix24 is more than just a project management tool - it's a collaboration platform for your business. In each project group, you'll find all of the files related to that specific project, while all tasks can be assigned or delegated to colleagues at any step of the process, with a Kanban board view option if you prefer.

You can track how much time an employee has spent on each task, with task counters available to keep track. Projects can also be shared online, so clients and those outside the organisation can track progress and contribute too. Bitrix is free for up to 12 users with a storage limit of 5GB, but that's enough for most small businesses.

Platforms: Android, iOS, Web

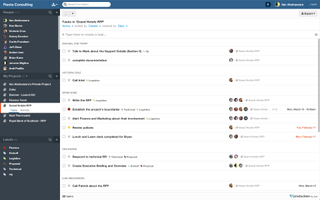

Producteev

Producteev, as the name suggests, seeks to make teams more collaborative and therefore productive, helping businesses make decisions on the spot to guarantee continuity.

You can set priorities for tasks, colour code them and add custom descriptions according to where they fit in your overall plan. You can also include deadlines to ensure they're completed on time. Each task can comprise subtasks too, with a tick box available for each, so teams can keep track of where they are on a wider task that may comprise several parts.

Every task can be transformed into an email to quickly assign it to someone, and of course, you can upload files via Box, Dropbox or from your device.

Platforms: Android, iOS, Web

Main image credit: Trello

Get the ITPro. daily newsletter

Receive our latest news, industry updates, featured resources and more. Sign up today to receive our FREE report on AI cyber crime & security - newly updated for 2024.

Clare is the founder of Blue Cactus Digital, a digital marketing company that helps ethical and sustainability-focused businesses grow their customer base.

Prior to becoming a marketer, Clare was a journalist, working at a range of mobile device-focused outlets including Know Your Mobile before moving into freelance life.

As a freelance writer, she drew on her expertise in mobility to write features and guides for ITPro, as well as regularly writing news stories on a wide range of topics.