The best Raspberry Pi projects

A collection of the best Raspberry Pi projects around for both experienced tinkerers and first-time hobbyists

Raspberry Pi projects can be a highly engaging way to test your mettle in programming and hone your skills in languages such as Python and Scratch. This is particularly true for those looking to use the Raspberry Pi for home automation.

To show off what this hardware is capable of, we've pulled together a list of the best projects for automating tasks, from feeding your pets to building your own smart assistant, all powered by one tiny but powerful mini computer.

A warning before we continue – many of these projects are a little more involved than those you might have encountered so far, so prepare to be challenged should you choose to try them out yourself.

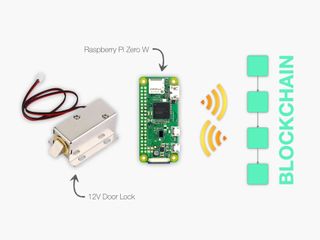

Build a Blockchain-powered smart lock

If you're keen to use your Raspberry Pi to make your home more secure, developer Simone Romano has demonstrated how you can use a Raspberry Pi Zero W to create a Blockchain-powered smart lock. The project will take around two hours to complete and is classed as an intermediate skill level build.

In terms of hardware, Romano uses a basic solenoid-based electric lock, that requires a dc 12V input to switch in the “open” state, while a mechanical spring will push it in “closed” state when not powered. This is paired with the IoTeX Blockchain for the smart contract infrastructure.

“The IoTeX platform combines blockchain, privacy technology, and decentralized identity (DID) to fuel the next generation of private smart devices. The IoTeX platform is built with openness and data ownership as first principles to unleash the next generation of private smart devices," explains Romano. "The Internet of Trusted Things is an open network where humans and machines can interact with guaranteed trust, free will, and privacy.”

For full instructions on how to build this smart lock, head over to Romano's step-by-step guide on Hackster.io.

Get the ITPro. daily newsletter

Receive our latest news, industry updates, featured resources and more. Sign up today to receive our FREE report on AI cyber crime & security - newly updated for 2024.

Build a smart home hub

Kuman 4 Relay Module

Our homes are becoming incredibly connected environments, with products such as smart energy meters, smart light bulbs, and smart door locks now being a common feature. Whether you're the sort of person that wants to transform their home into a digital haven, or even if you've only got a handful of smart devices, it's possible to connect all of that technology to a single access point – using just the Raspberry Pi.

In order to build this, you'll need a Relay Module, and incredibly powerful piece of kit that will let you connect the various devices around your home directly to your Raspberry Pi board. You'll also need to source some software to manage all of those devices – thankfully there are plenty of open source tools available – and an SD card to store it on.

For full instructions on how to put this all together, we're going to refer you to this great step by step guide. Be warned, a little technical know-how is required.

Build your own AI assistant

Google has partnered with the official Raspberry Pi magazine The MagPi to release a brand new add-on board, enabling makers to add voice control and artificial intelligence to their Raspberry Pi projects.

The board allows hobbyists to make easy use of Google's Cloud Speech API for voice recognition, as well as the Google Assistant SDK that provides the AI brain for the company's smartest devices.

Issue 57 of the MagPi comes complete with a free AI kit, including the new Voice HAT add-on module, a speaker, microphone, cables, button and even an enclosure to put it in - everything you'll need to make a homebrew version of Google Home.

Power Cat Feeder

We all love our animals, but sometimes an automated pet feeder sounds like a pretty nifty thing to have around the house.

We at one time showcased the work of David Bryan, who back in 2013 found himself regularly going out of town on extended trips, without being able to source a cat-sitter. Of course, one option was to simply leave out an enormous bowl of cat food, but this wasn't exactly convenient, not to mention rather unhygienic.

Through his Power Cat Feeder project, however, he could make sure they didn't overeat before going hungry. Presumably, too, it can be used to feed any animal - including humans.

Since then there have been a bunch of iterations on this idea, some of which look rather elegant. Take for instance Sam Storino's solution to help placate starving felines at 3 am. For this project, he used a dry food dispenser, a rotation servo motor, jumper cables, a Wi-Fi dongle and a Raspberry Pi board – in this case, a Raspberry Pi 2.

For full assembly instructions, head to his step by step guide.

Build a Pi Pico-powered exercise bike

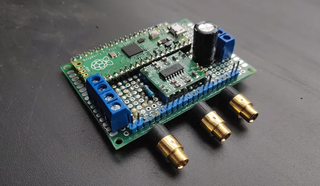

Reddit user Pubudeux has used a Raspberry Pi Pico to create an exercise bike controller than can monitor exercise sessions and provide audio output for cycling classes.

The Pico board is used in tandem with a Pam 8403 amplifier board. It's also using a battery voltage sensor, an infrared sensor and is connected to an LCD screen via I2C. These sensors count how many pedal strokes are occurring per minute and at what resistance, and once the cadence is determined, the data can be read out in real-time. What's more, the controller equips the exercise bike with the ability to play music through its built-in speaker or run training videos, much like commercial devices including the Peloton.

"It is a Raspberry Pi Pico board, PAM8403 amplifier board, with connections set up for an I2C LCD screen, battery voltage sensor, and infrared sensor," Pubudeux explains of his build. "This isn't the finished product, but will go inside a case and have sensors and speakers attached to it."

Full details of the project can be found at Hackster.io.

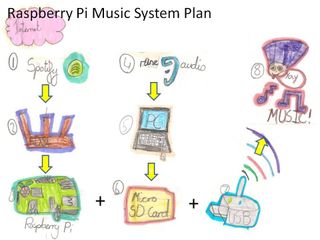

Pi Multi-Room Music Player

Buying a bespoke multi-room sound system can be costly - but thanks to Jezsinglespeed at Instructables, you can now do it yourself for under £100. It's a simple four-step project, which is perfect if you want to introduce children the power of the Raspberry Pi.

All you need is one wireless streamer, wireless receivers (no. depends on how many rooms) and of course your trusty Pi.

The Pi Musicbox software is used to make the magic happen and the results are just as good as any off the shelf product.

Set up a video conference using your TV monitor

In the age of remote working, video conferencing has been crucial to keeping teams communicating and collaborating. However, it has also led to many suffering from video call fatigue, which isn't very helpful in times when lockdown restrictions are still enforced. One good antidote which doesn't involve deleting all video conferencing apps is to simply liven up the call experience, such as by putting your colleagues – or friends and family – on the big screen.

Phil Wilson, hardware hacker at IoT fleet management provider Balena, discovered a way to turn a simple TV monitor into a video window using a Raspberry Pi 4B and a webcam.

"When you put a video call onto your TV several things are very different," Wilson wrote in a blog post. "It felt more social. And I felt that if I had a loved one who was socially isolated, and I could place myself into their room, on their TV, and them on mine it would be a much connecting experience than a phone call or video call on a mobile device. It felt like the next best thing to actually being there."

Current page: Best Raspberry Pi home automation projects

Prev Page Raspberry Pi: Top 37 projects to try yourself Next Page Best Raspberry Pi camera projects

Clare is the founder of Blue Cactus Digital, a digital marketing company that helps ethical and sustainability-focused businesses grow their customer base.

Prior to becoming a marketer, Clare was a journalist, working at a range of mobile device-focused outlets including Know Your Mobile before moving into freelance life.

As a freelance writer, she drew on her expertise in mobility to write features and guides for ITPro, as well as regularly writing news stories on a wide range of topics.