Best identity theft companies

With data breaches happening daily, it’s time to check out the best identity theft companies to safeguard your information

According to a recent study, there were over 12,000 data breaches in the US between 2008 and 2020. That’s millions of people who have had their sensitive personal data exposed online. Even today, you will be surprised at how easy it is to find leaked credit card details online if you know where to look.

Whether you are an individual or run or own a business, it has become more important than ever to secure your identity from potential fraud, be it online or offline. A good identity theft protection service can help you do just that.

The best identity theft companies use a variety of techniques to keep your personal data safe from online abuse. In exchange for a fee, they will carefully monitor any data breaches to make sure that your information hasn’t been exposed anywhere. And if there’s a breach that concerns you, knowing that your information has been compromised at the right time can make all the difference.

The best identitity theft companies for protecting your identity

1. Norton LifeLock

| Pros | Cons |

|---|---|

| Proactive support | Expensive |

| Theft insurance | Row 1 - Cell 1 |

| Dark web monitoring | Row 2 - Cell 1 |

| VPN service | Row 3 - Cell 1 |

LifeLock was acquired by Symantec, the company behind Norton Antivirus, in 2017. Since then, it has made great strides establishing trust as an identity protection service. Its yellow interface denotes a feeling of trust, marked by a clean dashboard that gives you all the necessary tools right at your fingertips. Just by looking at the UI, you can tell that this is a company that cares about customer experience.

Right now, LifeLock offers comprehensive packages that monitor online traffic, dark web activity, finance applications, court records, and much more to issue real-time alerts whenever someone attempts to do anything criminal under your name. In the event that your identity does get stolen, LifeLock will take care of all the legal heavy lifting so that you can continue to live your life. Its team will make the necessary calls, inform all concerned authorities, and fill official forms to ensure that everything gets back to normal as soon as possible.

There are several plans to choose from. LifeLock Standard, which costs $8.99 a month, offers credit monitoring and social security number protection. It also comes with $25,000 in theft protection insurance. LifeLock Select, which also costs $8.99, offers all of this on top of a virtual private network (VPN). The pricing is only for the first year, however, after which Standard costs $12 and Select costs $15 a month. Then there’s LifeLock Advantage, which costs $20 a month. Finally, LifeLock Ultimate Plus sets you back $34.99 and offers $100,000 in insurance.

Read our full Norton LifeLock review.

| Price | $8.99 a month+ |

| Insurance coverage | $25,000+ |

| Features | Credit monitoring, social security number protection, dark web activity |

2. IdentityForce

| Pros | Cons |

|---|---|

| Reasonably priced | None, really |

| Anti-phishing and keylogger protection | Row 1 - Cell 1 |

| Real-time alerts | Row 2 - Cell 1 |

| Intuitive dashboard | Row 3 - Cell 1 |

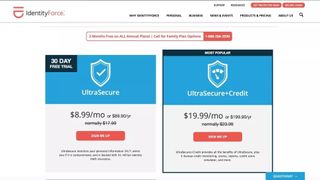

Based in Massachusetts, IdentityForce has versatile protection plans for individuals, businesses, and government agencies alike. Its most basic plan offers access to credit reports from providers like Equifax and Experian, whereas higher-tier subscriptions offer monitoring services for social security numbers, bank accounts, mailing addresses, and even the sex offender registry. With that, IdentityForce keeps track of any potential abuse of your identity and takes necessary steps to secure you against fallout.

Software-wise, IdentityForce is available as a web-based client as well as a smartphone app. It even throws in additional security services like keylogger protection and anti-phishing software to stop your data from being stolen in the first place.

There’s also a social media monitoring network that scans for fake accounts under your name on Facebook, Instagram, YouTube, and Twitter. All of this, combined with regular alerts via email and messaging, provide for complete peace of mind as you go about your daily business.

IdentityForce is priced reasonably, starting at just $8.99 a month, and it comes with an insurance cover of up to $1 million. If you require additional features, you can also upgrade to a plan that adds credit monitoring for a total of $19.99 a month.

| Price | $8.99 a month+ |

| Insurance coverage | $1 million |

| Features | Credit report monitoring, social security protection, social media lookups |

3. Experian IdentityWorks

| Pros | Cons |

|---|---|

| Affordably priced | Focuses mainly on credit |

| Clean interface | Past breaches may reduce trust |

| Social media and dark web scanning | Row 2 - Cell 1 |

| Court record monitoring | Row 3 - Cell 1 |

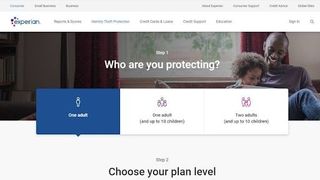

Experian is the same credit reporting agency that’s infamous for a 2015 data breach that exposed the email accounts of 15 million customers. While that doesn’t necessarily exude confidence, its identity protection service may still be worth considering in 2021. IdentityWorks specializes in credit report monitoring, but it also keeps track of other activity, like dark web activity, social media accounts, court records, and bank transactions, to give you a comprehensive protection plan against identity theft.

Once you’re logged in to the interface, IdentityWorks presents you with a professionally-designed dashboard that goes to great lengths to ensure that you understand what you’re looking at. Everything is very clearly explained, with an onboarding wizard that takes you through the steps for getting set up. There is no jargon anywhere, and the console is very easy to familiarize yourself with.

In terms of payment plans, the IdentityWorks Plus plan consists of credit report monitoring and dark web scanning. It comes with $500,000 in identity theft insurance, and costs $8.33 a month for one adult and up to 10 children. It’s easy to add another adult to the plan for another $8.33.

IdentityWorks Premium offers more well-rounded protection, monitoring court records and social networks, among other things. The insurance amount also goes up to $1 million, and the plan costs $19.99 a month.

| Price | $8.33 a month+ |

| Insurance coverage | $500,000 |

| Features | Credit report monitoring, dark web scanning, court record monitoring |

4. PrivacyGuard

| Pros | Cons |

|---|---|

| Pick only what you need | No family plan |

| Trial plan available | No social media monitoring |

| Anti-keylogger and secure browser | Row 2 - Cell 1 |

Owned and operated by the Trilegiant Corporation, PrivacyGuard offers credit reporting and identity protection services in exchange for a fee. At the base level, the credit monitoring plan is actually offered separately from identity protection, which means that if you want both, you’ll need to subscribe to the costliest plan.

Services include everything from social security monitoring to credit fraud protection, depending on the plan you choose. While this means you can pick and choose what you need, it also stands to reason that you’ll end up paying more if you need both services.

The identity theft protection service comes with dark web surveillance, social security event monitoring, annual public records reports, online fraud assistance, stolen credit card protection, anti-keylogging software, and secure web browsing. The credit report monitoring solution actually costs more, offering three-bureau credit reports, credit record monitoring, and online fraud assistance. It also comes with an anti-keylogger and a secure browser.

PrivacyGuard ID Protection costs $9.99 a month and offers $1 million in insurance. PrivacyGuard Credit Protection sets you back $19.99 a month and offers 24/7 credit monitoring. PrivacyGuard Total Protection offers the benefits of both plans for $24.99. If you’d like to try out the service before you commit, you can go for the trial plan, which costs $1 per day for the first 14 days of your subscription.

| Price | $9.99 a month+ |

| Insurance coverage | $1 million |

| Features | 24/7 credit monitoring, identity theft insurance, dark web surveillance |

5. Identity Guard

| Pros | Cons |

|---|---|

| AI-powered enhanced protection | Annual credit reports only |

| Detailed scans and real-time alerts | No credit monitoring in base plan |

| Credit monitoring features | Row 2 - Cell 1 |

Founded in 1996, Identity Guard uses proprietary machine learning algorithms developed by IBM Watson to constantly scan the internet for potential threats of identity theft. It issues real-time alerts to protect users against data leaks through websites, public records, and social media activity. For example, it scans the dark web for any potential mentions of your social security number to ascertain whether you might be exposed. It also provides annual credit reports to its users through Equifax, Experian, and TransUnion.

In a market saturated with competition, Identity Guard adds extra edge to its offering by using IBM Watson’s artificial intelligence technology. This strategic partnership helps the identity protection service identify possible data leaks faster than any other service provider on this list. It also comes with secure browsing and payment protection tools as an added bonus to subscribers. The highest-tier plan also includes a monthly credit score from TransUnion.

Identity Guard offers three different subscription plans. Value provides the most basic protection, with dark web scanning, safe browsing, and anti-phishing tools. You also gain access to a caseworker who will assist you with reclaiming your identity should the worst-case scenario ever happen. It costs $7.50 a month for individuals and $12.50 a month for families.

The Total plan offers all of this along with credit monitoring for $16.67 a month for individuals and $25 a month for families. Finally, the Identity Guard Ultra plan provides the most benefits, with three-bureau credit reports, card monitoring, criminal records scans, and sex offender registry monitoring. It costs $25 a month for individuals and $33.33 a month for families.

| Price | $7.50 a month+ |

| Insurance coverage | $1 million |

| Features | IBM Watson, secure browsing, credit score monitoring |

6. Complete ID

| Pros | Cons |

|---|---|

| Reliable provider | Lacks distinguishing features |

| Comprehensive credit monitoring services | Interface could use a rework |

| $1 million insurance with zero deductibles | Row 2 - Cell 1 |

Complete ID is the product of a partnership between Experian and Costco. It offers wholesome identity protection services at attractive price rates. It’s packed with features like dark web scanning and social security monitoring. Apart from identity protection, Complete ID also offers credit monitoring and identity restoration services. While the user interface is a bit clunkier than the other providers on this list, the highly affordable packages make it well worth the compromise.

Complete ID scans court records, criminal databases, financial accounts, and change of address requests to locate and flag potential cases of identity theft. It also scans the dark web for your social security number (SSN). As it is owned by Experian, you can expect an in-depth credit monitoring service to go along with your plan. Detailed credit reports are obtained from all three credit bureaus and alerts are issued whenever someone opens an account with your information.

In case your identity gets stolen, Complete ID offers theft coverage of up to $1 million with no deductibles. This should be enough to cover things like legal fees, lost income, and emotional duress. The interface is clean and easy to use, even if slightly outdated.

Complete ID requires you to have a Costco membership in order to sign up. It usually costs $13.99 per user per month, but Costco Executive members get a discounted rate of $8.99. You can extend your coverage to include up to five children for another $3.99 a month ($2.99 if you have a Costco Executive membership).

| Price | $13.99 a month+ |

| Insurance coverage | $1 million |

| Features | Three-bureau credit reports, dark web scanning, court records checking |

7. ADT Identity Theft Protection

| Pros | Cons |

|---|---|

| Trusted brand | Annual credit report only |

| Highly affordable | Lacks distinguishing features |

| $1 million in theft protection | Row 2 - Cell 1 |

ADT is a company best known for its smart alarms and motion detectors. ADT Identity Theft Protection, however, is a new service that expands its offerings to security in the digital space. For a surprisingly affordable price, the company gives you access to features like theft insurance, credit monitoring, dark web scanning, financial account security, passport monitoring, and more. While these are run-of-the-mill features that you can get from any service provider, the brand reputation and price affordability alone make this deal worth considering.

Most services at this price point offer $100,000 to $500,000 in insurance. But not ADT. With no-strings-attached coverage up to $1 million, ADT Identity Theft Protection makes for a solid offering indeed. You are limited to only one credit report per year, but you can always obtain unlimited free credit reports from a website like Annual Credit Report.

There aren’t any major extras to speak of, but the package covers your most essential identity protection needs. Experian and Equifax offer limited plans at a similar price range, but they have both experienced data breaches that have been on the news for quite some time.

ADT Identity Theft Protection costs $9.99 a month. You can’t just sign up online, though; you have to call a dedicated hotline. You can also chat with the sales team online if you have questions.

| Price | $9.99 a month |

| Insurance coverage | $1 million |

| Features | Dark web scanning, annual credit report, passport monitoring |

- Read our guide to the best online security suite

Get the ITPro. daily newsletter

Receive our latest news, industry updates, featured resources and more. Sign up today to receive our FREE report on AI cyber crime & security - newly updated for 2024.

Ritoban Mukherjee is a freelance journalist from West Bengal, India. His work has been published on Tom's Guide, TechRadar, Creative Bloq, IT Pro Portal, Gizmodo, Medium, and Mental Floss. Ritoban is also a member of the National Association of Science Writers.